The recovery rebate credit calculator

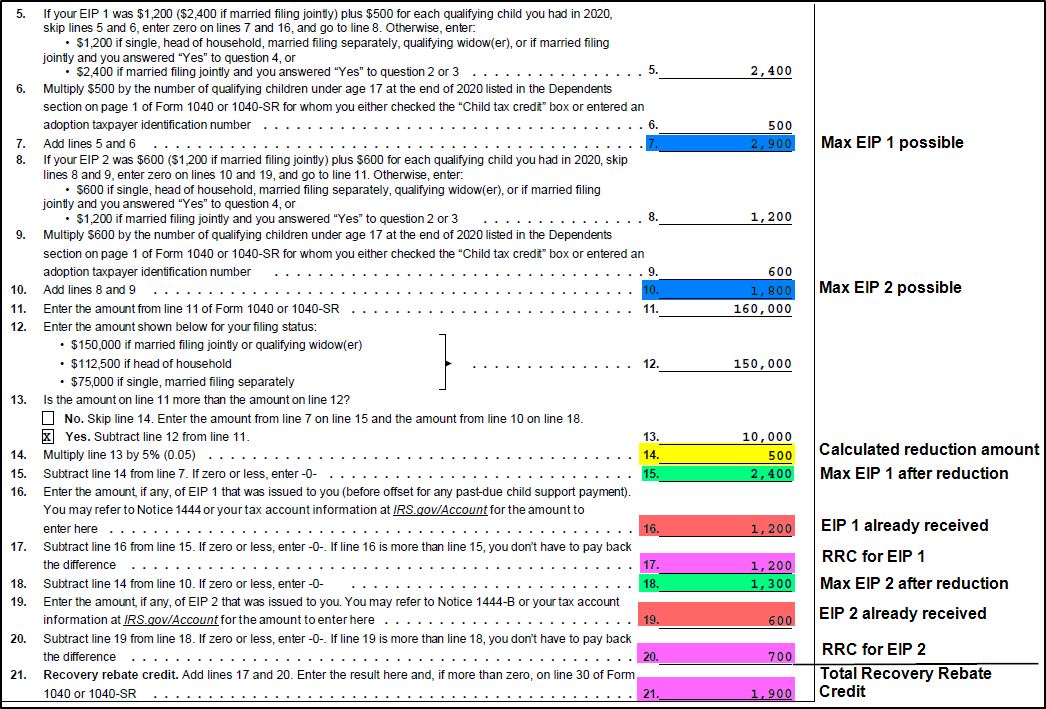

Residents will receive the Economic Impact Payment of 1200 for individual or head of household filers and 2400 for married filing jointly if they are not a dependent of another. Basic Calculation 1st EIP 1200 X___enter of eligible.

Recovery Rebate Credit Worksheet Explained Support

Same eligibility requirements as the 1st EIP.

. The following regularly questioned queries relate to the 2021 and 2020 Rehabilitation Rebate Credit score. Your Business Could Qualify. The Recovery Rebate Credit is calculated based on the taxpayers 2021 income filing status and eligible dependents.

Schedule A Discovery Call Today. If you claim the head-of. Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4700.

Same child eligibility requirementsas the first EIP. If you werent able to claim your earlier 1200 or 600 stimulus checks you can do so on your 2020 tax returns. The Recovery Refund Credit rating will not be offered to.

The base credit amount for most persons in 2021 is 1400. The gross amount based on either the 2018 or 2019 tax returns of the payment is reduced by 5 for each 100. If you file a joint 2020 tax return with the same spouse combine your first and second payment amounts to calculate the Recovery Rebate Credit.

People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return. Recovery Rebate Credit Calculator. Americans received a tax-free payment from the US government during 2021 to help recover the economy from COVID-19.

This is the same criteria used to determine eligibility for the Child Tax Credit. When they file their 2020 return they will claim their child on the return and determine they should receive 1100 in additional recovery rebate credit 500 for round one. Tax Estimator Calculator.

Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Ad The Recovery Friendly Workplace Tax Credit Is Designed To Reward Eligible Employers. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund.

This is made up of 2900 1200 for Alex 1200. You received only a partial Economic Impact Payment of the maximum amount or credit of 1400 or 2800 plus 1400 for each qualifying child. The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

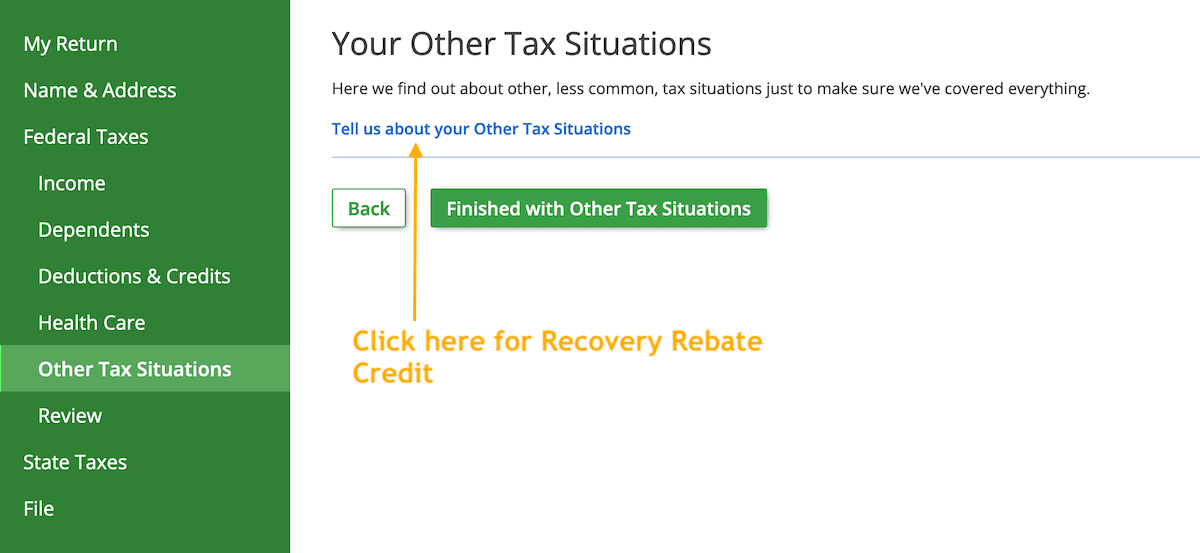

See the 2020 Recovery Rebate Credit FAQs Topic A. If you experienced life. You must file a 2020 tax return to claim a 2020 Recovery Rebate Credit even if you dont usually file a tax return.

600 per eligible child. Ad Borrowers Of Paycheck Protection Program Can Now Qualify For The Employee Retention Credit. If you did not receive a.

99000 maximum for single or married filing single with no children 146500 maximum for head of household filers with no children 198000 maximum for married filing jointly with no children. How to Calculate the Recovery Rebate Credit. If youre married filing a joint tax return or a qualifying widow er the amount of your second stimulus check will drop if your AGI exceeds 150000.

Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Provisions in the bill authorized a third round of stimulus checks worth 1400 for each eligible person 2800 for couples plus an additional 1400 for each dependent. If your income is 73000 or less you can file your federal tax.

Your recovery rebate credit is calculated using a base amount just like the stimulus cheques. Ad The Recovery Friendly Workplace Tax Credit Is Designed To Reward Eligible Employers. Use the Recovery Rebate Credit 28.

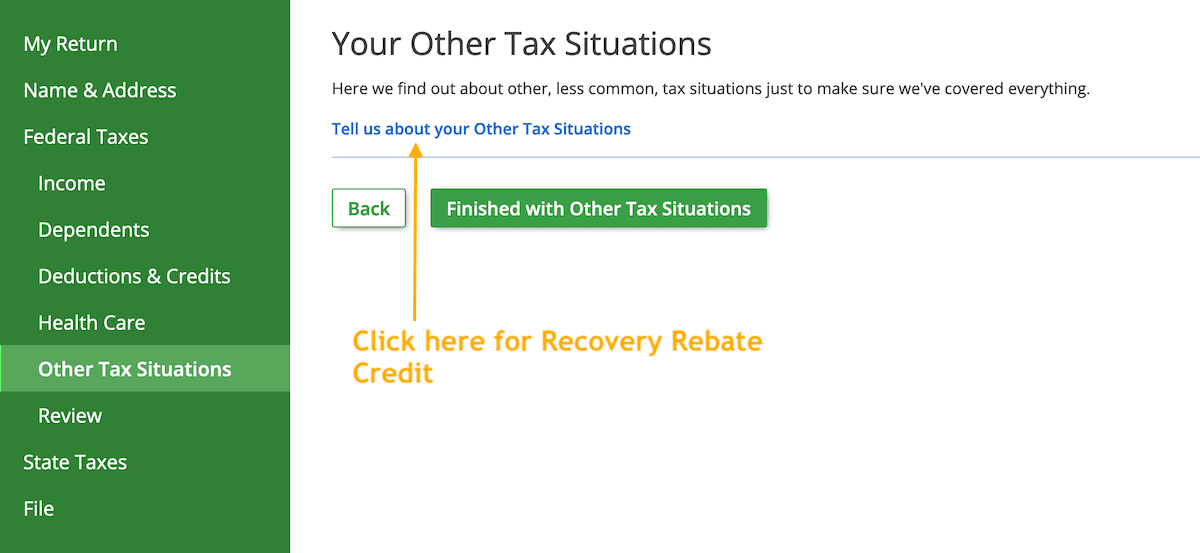

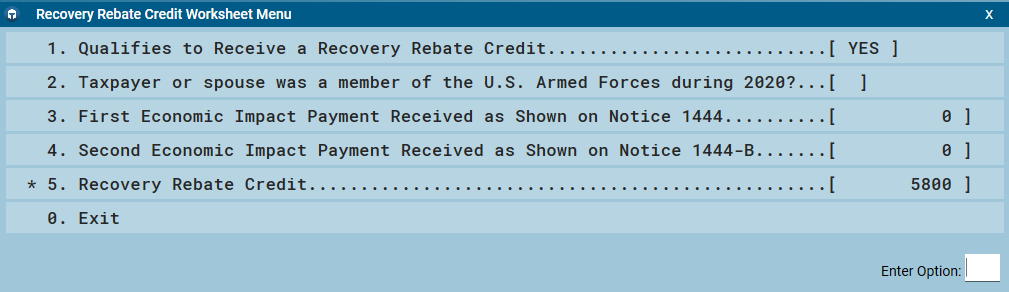

Desktop 2020 Recovery Rebate Credit Support

Irs Cp 12r Recovery Rebate Credit Overpayment

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit Worksheet Explained Support

Recovery Rebate Credit How Much Can I Claim For 2021 Melton Melton

How Much Money You Ll Get From The 2020 Coronavirus Recovery Rebate

Recovery Rebate Credit On Amended Return

Irs Recovery Rebate Tax Credit 2022 How To Claim It Next Year Marca

Recovery Rebate Credit 2022 Eligibility Calculator How To Claim

2020 Recovery Rebate Credit Topic G Correcting Issues After The 2020 Tax Return Is Filed Nstp

Recover Rebate Credit

Ready To Use Recovery Rebate Credit 2021 Worksheet Msofficegeek

Missed Stimulus Check Deadline Don T Worry You Can Still Claim It As A Credit Here Is How Internal Revenue Code Simplified

Recovery Rebate Credit 2021 2022 Credits Zrivo

Recovery Rebate Credit 2021 Tax Return

Irs Cp 11r Recovery Rebate Credit Balance Due

Recovery Rebate Credit H R Block